By Adrian Requena

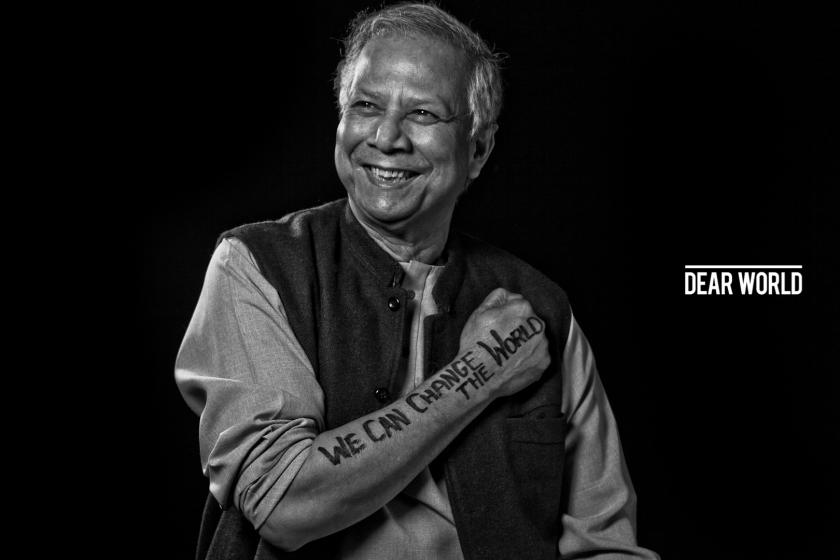

- “Portrait of Muhammad Yunus”

In 2006, Muhammad Yunus was awarded the Nobel Peace Prize for innovating the credit market. He established the first microcredit institution, Grameen Bank, for the purpose of empowering the poor and giving them an opportunity to become independent entrepreneurs. Yunus had another equally as important goal when he envisioned the revolutionary microcredit service; gender equality.

At the HUB Chamber of Commerce in Santo Domingo, Dominican Republic, Yunus addressed multiple microcredit institution and delivered the conference “Eradicating world poverty, one loan at a time”. Here, he urged the present party to note and continue integrating his principles that make microcredit such a successful venture.

Yunus seems to have noticed that lending money to women is more beneficial to the household. He argues that women are more cautious and therefor spend differently than men. We will discuss this later on in this blog. First, it is crucial to understand the inequality women face in most, if not all, developing countries.

The Reality of Women in Developing Countries

In Julie Shaffner’s “Development Economics: Theory, Empirical Research, and Policy Analysis”, she notes that the lives of women and girls in developing countries are much harder than that of men and boys. Within households, women and girls frequently consume less, work longer hours, and have generally fewer rights compared to men and boys. Shaffner continues to describe what it is like being a girl in South Asia and China, where they receive lower quality of food, are less likely to receive health care when they are sick, and have a higher mortality rate. Women work longer hours than men taking care of all the household chores and jobs needed to keep the family afloat.

This being said, they have more restrictions on their freedom and fewer rights to own property. In many developing areas women have little to no decision-making power when it comes to the finances of the household. Yunus recalls a conversation he had with a woman in India about to receive a loan. She told him, “I have not touched money in my life… how am I going to use this money if I do not know how to handle it?” There is clearly something wrong with this picture, good thing Yunus recognized the problem and decided to do something about it.

Yunus continues to address exactly what his approach towards gender equality was. Under normal circumstances, bank loans should aim at women participation levels of about 50%, likewise for men. Grameen Bank aimed at making 90% of the loans go to poor women. This goal and change of focus by a bank really made an impact and truly empowered women who previously did not have many opportunities. Looking at empirical data around the developing world, this makes a lot of sense. Women are more likely to be self-employed than men. Shaffner reports that in urban Vietnam, “more than 40% of men and more than 60% of women are self employed”. It wasn’t until later that empirical research began to show what the real outcomes of lending to women were.

Impact of Women Decision-Makers

Katherine Esty, Ph.D in social psychology and founder of Ibis Consulting Group, spoke with Yunus in 1994 and was enlightened by the notion that lending to women almost always leads to better spending in ways that help their families over time. Yunus told Esty that women are less likely to use the borrowed money to buy unnecessary goods and luxuries like men, instead, they do what is best for the family and spend money on food and health as well as goods like cows, chickens, or seeds that could be sold and profited off of in the future.

This hypothesis can also by backed up by evidence presented by Shaffner from empirical research in Brazil. Thomas (1990) found that non-labor income in the hands of women had a bigger positive impact on family health and child survival rate than said income in the hands of men. Shaffner continues to point out a study by Duflo (2003) in South Africa. They found that pension income in the hands of women had a positive impact on girls nourishment in the household, while the same could not be said for pension income in the hands of men.

Much like Yunus before, Shaffner comes to the conclusion that “channeling development program benefits to women rather than men can increase program impact on household nutrition and other investments in the human capital of children”.

Prior to Yunus’ Grameen Bank, the participation of women in financial decisions in the household were close to none, Esty points out that 98% of borrowers at commercial banks in Bangladesh were men. Apart from being unjust and wrong, this is extremely inefficient and unproductive. Looking at this from an economic stand point, having 50% of the population that work the hardest and know what is best for the household not able to access capital was completely inefficient.

In order to alleviate poverty in the developing world, Yunus realized, women must be given equal rights when it comes to borrowing and making the tough decisions in the household. Hopefully Yunus’ believes and standards remain at the core of all microcredit institutions around the world.

References:

Pascual, Kelvin. “Yunus: prestarle a mujeres es más beneficioso para familias.” Hoy digital. N.p., 17 Mar. 2017. Web. <http://hoy.com.do/yunus-prestarle-a-mujeres-es-mas-beneficioso-para-familias/>.

Esty, Katherine. “5 Reasons Why Muhammad Yunus Focuses on Lending to Women.” Web log post. Impatient Optimist . Bill & Melinda Gates Foundation, 10 Jan. 2014. Web. <http://www.impatientoptimists.org/Posts/2014/01/5-Reasons-Why-Muhammad-Yunus-Focuses-on-Lending-to-Women#.WPaLqGTyub8>.

Adrian, this is a very inciteful article and I really enjoyed reading it. As an international student from India, I have been able to travel to many countries and actually observe many such similar incidents. Your point when you mention that they get lower amount of health care and food and sometimes wages is extremely apparent. One of the points I would like to mention to you is that in many places in India, if a woman owns property or tries to engage in dealing with others (this happens mostly in villages), the contract is considered to be void.

A question I wanted to ask you would be that granted that a woman gets a loan and that she makes better choices on spending those loans than men, if she does want to have access to property right or start a business do you think that would be possible? I feel that the fact that the society is so adamant to not let woman enter into business or make decisions might prevent them from taking loans. Has the stigma started to come down and if not what can the Grameen Bank do in order to help increase the take up of the loans.

-By Abhinav Saraogi

LikeLike

Yunus believed very strongly that microcredit could empower women, and his ideas are consistent with some evidence about unearned income such as the South African pension. But given that microcredit doesn’t seem to have much effect on business profits or consumption, I am doubtful that the loans themselves will be as transformative as Yunas hoped. There are other aspects of microcredit, like the training, social connections forged through participation in borrowing groups, and even the commitment mechanism provided by requiring regular repayment, that might affect gender roles more than credit itself.

LikeLike

The findings from these studies identify an important concept that could possibly improve the conditions of well-being of many developing countries. You did a really good job discussing how providing loans to woman are more beneficial than providing the loans to men. I thought that this finding was very interesting because normally we think of the men in the household to “take care” of the family’s well-being. It was interesting that the women in the household are more likely to spend the money on their families and health. You did an excellent job in discussing the similar results from multiple studies to strengthen their argument.

LikeLike

It definitely is unfortunate the way women are treated in developing countries and other countries compared to the U.S. so it is good to see someone striving to make a difference in this area. I also agree that women usually are more responsible than men, especially when it comes to saving and spending money. Teaching women the basics of the microcredit world can benefit these women and their families. It will be interesting to see if other countries take notice and soon allow women these finance opportunities.

-Devin Griffiths

LikeLike

As Dr. Goldberg suggested, I think it’s really important to think about the specific channels through which women may be empowered. If the typical direct outcomes of microcredit are not huge for most households, how else may women be in a position to have more say over household decisions? Can we fit that into the household bargaining model, or would a different framework be more appropriate?

LikeLike

A good read indeed. This article reminds me of Aga Khan III when he said while addressing to All Pakistan Women Association (APWA) that, ” Biologically the female is more important to the race than the male. While average women are capable of earning their own livelihood like men, they are the guardians of the life of the race, and only through their natural constitution are they able to bear the double burden. Experience shows the strong probability that the active influence of women on society, under free and equal conditions, is calculated not only to bring about practical improvement in the domestic realm, but also a higher and nobler idealism into the life of die State. Those who know Muslim society from within readily admit that its higher spiritual life owes a great debt to the example and influence of women. Today, as in the lifetime of the Prophet, probably the majority of devout and reverent followers of His teaching are women.

No progressive thinker of today will challenge the claim that the social advancement and general well-being of communities are greatest where women are least debarred, by artificial barriers and narrow prejudice, from taking their full position as citizens. Hence it is with deep sorrow that the admission must be made that the position of Indian women is unsatisfactory, that artificial obstacles to their full service of the commonwealth are every where found, and that, from the point of view of health and happiness alike, women suffer needlessly through chains forged by prejudice and folly … These and other social evils have so handicapped India that it is impossible to conceive of her taking a proper place in the midst of free nations until the broad principle of equality between the sexes has been generally accepted by her people.

The present abrogation of this principle is the more to be deplored since the natural intelligence and ability of Indian womanhood are by no means inferior to those of their emancipated sisters. There are abundant indications that the Indian woman, given the same chances as her more fortunate Western sisters, could contribute no less fully to the general advancement.”

His Highness the Aga Khan III

LikeLike